Key Points:

- CBRS is the first major new chunk of mid-band spectrum to be made available for 5G.

- The FCC auction for "Priority Access Licenses" for the CBRS band has concluded, and Verizon and Dish Network were the big winners.

- The C-Band auction is next - an even bigger and more important chunk of spectrum that will be key to the widespread deployment of fast 5G in America over the years ahead.

"Spectrum" to cellular carriers is as important as real estate is to land developers - and there is a seemingly infinite demand for this scarce natural resource.

"Spectrum" to cellular carriers is as important as real estate is to land developers - and there is a seemingly infinite demand for this scarce natural resource.

As the world transitions to 5G the need for new spectrum, particularly "mid-band" spectrum, is only growing.

So it is a very big deal when new chunks of spectrum become available for cellular use.

There are two new bands that will be coming online soon that will be extremely important to the future of 5G: CBRS, and C-Band.

Both of these bands are "mid-band" spectrum - considered to be in the sweet spot for 5G networks. Think of it as prime beachfront real estate - and the carriers are itching to move in and start building.

So just what is CBRS all about? What is the deal with C-Band?

And how will these bands impact emerging 5G networks?

Table of Contents

Video Version

Subscribe to our YouTube Channel

The Race For Mid-Band Spectrum

So why does everyone want more mid-band for 5G?

Most low-band longer range cellular spectrum that exists is already in use for 4G/LTE - and while dynamic spectrum sharing (DSS) will soon allow 5G to layer on top of this spectrum, it will only be able to deliver a "really good 4G" experience.

On the other hand - mmWave 5G spectrum is blazingly fast, but such short range that it is only suitable for in the most congested urban area.

Mid-band spectrum is the sweet spot for 5G - much faster than low-band, and yet still able to deliver decent coverage.

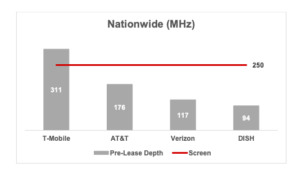

T-Mobile acquired a massive amount of mid-band spectrum by purchasing Sprint. This spectrum had been used for Sprint's LTE Band 41, but Sprint never had the resources to really take advantage of all the spectrum it controlled.

Now that T-Mobile is in charge, it is rapidly moving to deploy all this spectrum for fast mid-band 5G - with 90 cities and towns enabled for mid-band 5G already, and "thousands" more coming by the end of this year.

T-Mobile brags about how far ahead it is:

“This is our 5G strategy in action. Mid-band is the 5G spectrum, and T-Mobile has more of it than anyone. We have nearly twice as much low and mid-band spectrum as AT&T and nearly triple that of Verizon. And that means T-Mobile is the only one capable of making the world’s best 5G network a reality.”

And indeed - when it comes to mid-band, the other carriers are in a rush to catch up, willing to pay billions for a slice of CBRS and C-Band.

CBRS: Shared Cellular Spectrum

The Citizens Broadband Radio Service (CBRS) band is a unique chunk of 3.5 GHz spectrum that was first authorized for cellular usage back in January (our story) - but that was just the beginning for CBRS.

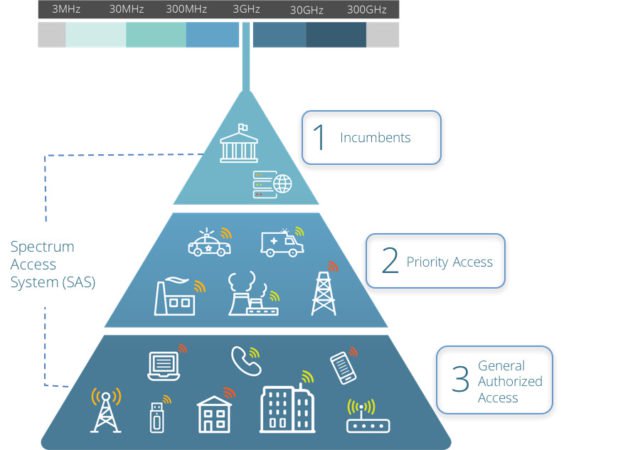

You see - what makes CBRS special is that the airwaves are shared, and there is a complicated priority system in place that determines who can use the spectrum at any given place and time.

This system opens the door for the big carriers to add extra 4G or 5G capacity in locations where they need it, but it also enables smaller carriers to deploy regional 5G networks, and it even enables private cell networks - like on a corporate or college campus, at a factory, or across an industrial site.

So who gets priority? That is determined by who holds a "Priority Access Licenses" (PAL) for the CBRS spectrum in a given county.

The FCC recently wrapped up a $4.6 billion auction selling these "Priority Access Licenses" (seven licenses per-county) across all 3,233 counties in the United States - and now we know who the big winners are: Verizon and Dish Network.

But cable companies Charter, Comcast, and Cox also bid hard - investing in a foundation for their own cellular networks in the markets they operate in.

And some companies you wouldn't suspect invested as well to build private networks - like Chevron, John Deere, and even Texas A&M University.

CBRS Spectrum Sharing Explained

Most of the airwaves used for cellular communication are licensed so that a single company controls access to a given set of channels.

This is why there are so few cellular carriers - a new company can't just come along and build a cell tower and start transmitting, since all the current spectrum is already licensed.

This is in sharp contrast to Wi-Fi, where the spectrum is unlicensed and anyone can set up a Wi-Fi network wherever and whenever they want to - even if it causes congestion or interferes with other Wi-Fi networks nearby.

The CBRS band is the first attempt to deploy cellular spectrum that has the open access flexibility of Wi-Fi, but with enough controls in place that it can be reliably used for cellular as well.

Much of the CBRS spectrum is already in use by military radar and a few other specialized incumbents.

These expensive legacy systems can't be relocated to use other spectrum to make more room for cellular - but they are also making poor use of the airwaves, only needing the spectrum during limited times and in limited locations.

What if there was a way to let cellular devices use these airwaves when the military didn't need it?

To allow competing demands to co-exists, the CBRS band is pioneering an innovative approach to sharing access to spectrum - with military radar and existing satellite operations grandfathered in with highest priority while in active use, then there is a second tier of Priority Access Licenses (PAL) that has now been auctioned off to telecommunications companies for 5G and expanded LTE service.

Finally, there is a third tier of access that is open to any device without any license at all - similar to how Wi-Fi works. Devices operating at this level will have to be a good neighbor with other nearby devices, and they will need to clear out when higher priority users come along.

It is all fiendishly complex behind the scenes - but if everything works as designed, CBRS opens up a major chunk of new spectrum that will add a significant amount of much needed mid-band 5G capacity to the airwaves.

CBRS Auction Winners, and No-Shows

The big winner in the CBRS auction was Verizon - which committed $1.89 billion for 557 licenses, focused on just 157 counties.

The big winner in the CBRS auction was Verizon - which committed $1.89 billion for 557 licenses, focused on just 157 counties.

Verizon's strategy was to suck up as much priority bandwidth as it could in key urban areas where Verizon desperately needs more capacity for deploying 5G. In many of these areas Verizon bought four CBRS licenses (40 MHz total) - the maximum amount that the FCC will allow a single company to control.

Dish Network on the other hand took a very different strategy - investing $913 million for 5,492 licenses - paying half as much for 10x the spectrum to establish a foundation for a broad nationwide 5G network.

The next three largest bidders were all cable companies - Charter (Spectrum) spending $464 million, Comcast (Xfinity) spending $458 million, and Cox spending $212 million - all looking to get control of spectrum in their key markets.

The rest of the auction was dominated by small regional carriers and wireless internet service providers looking to secure bandwidth for more localized offerings, as well as a few companies looking for spectrum to build private networks on top of.

Almost completely absent from the bidding war was T-Mobile - the one US carrier that is already swimming in mid-band spectrum thanks to its acquisition of Sprint. T-Mobile only bought CBRS licenses in 8 counties, spending less than $6 million.

And AT&T sat this auction out entirely - likely planning to focus instead on the upcoming C-Band auction.

Next Up: C-Band Bonanza

The CBRS auction was just the prequel to the upcoming much larger C-Band spectrum auction - which is expected lead to a huge bidding war estimated to generate at least $38 billion in bids.

The C-Band auction starting on December 8th aims to free up an additional 280 MHz of spectrum (3.7 GHz - 3.98 GHz) - with larger channels and fewer transmit power restrictions than apply to the shared CBRS band.

Even more so than CBRS, C-Band has the potential to really unleashes what 5G technology is capable of.

But the catch with C-Band is that a lot of commercial satellite providers currently hold these licenses - so after the FCC's cellular auction concludes, there will potentially be a lengthy transition period while the winning cell carriers need to wait for the incumbents to move out.

The lower part of the band being auctioned is not expected be available for use until the end of 2021, and the remainder of the band will probably not be fully free for use until the end of 2023.

CBRS spectrum on the other hand has the advantage that it is available for carriers to take advantage of immediately - and many recent cellular devices can already take advantage of CBRS for 4G/LTE (check for LTE Band 48 compatibility) and soon we expect some 5G devices will be getting software updates to support 5G over CBRS on band n48.

But with only 150 MHz available in total on the CBRS band, broken into tiny 10 MHz channels, CBRS alone is never going to be able to fully deliver on the promise of what 5G networks should be capable of.

Verizon and AT&T are particularly in need of more mid-band spectrum to better compete with T-Mobile, so expect this upcoming C-Band auction bidding war to be fierce.

Mid-Band Compatibility Concerns

There are plenty of devices on the market compatible with T-Mobile's mid-band 5G, known as band n41.

But what about the other carriers, and their mid-band plans?

Will the current generation of 5G devices be compatible with all the new spectrum that is being auctioned off this year?

Maybe...

Internationally - C-Band is already the prime foundation for 5G networks rolling out in Europe, China, Australia and elsewhere, and there are three international C-Band 5G bands defined:

- n77 - 3.3 - 4.2 GHz

- n78 - 3.3 - 3.8 GHz (a subset of n77)

- n79 - 4.4 - 5.0 GHz

These big wide open bands were possible because there were no existing users of this spectrum in most places around the world, so all of the C-Band could be used for 5G.

But in the USA, the C-Band was already carved up into smaller slices for federal and satellite use - and the official 5G bands for using this spectrum for cellular in the USA haven't even been formally defined, and probably will not be until the auction concludes.

So the FCC isn't doing certifications to authorize C-Band cellular devices in the USA, and no device can even claim to be compatible, yet...

But theoretically - any 5G device in the USA that supports the international 5G bands n77 or n78 (like the new Inseego MiFi M2100 hotspot on Verizon that supports n78) should have the necessary radio components to potentially allow for a software upgrade to support mid-band 5G in the United States.

But that is only theoretical - it remains to be seen what current 5G devices actually end up getting this support.

Be prepared that early 5G devices may not be upgradeable to take advantage of all this new spectrum coming online in the years ahead - a major concern for AT&T and Verizon customers.

It is still early days in the evolution of 5G, after all...

Further Reading

5G Cellular Fundamentals for Mobile Internet - Our featured guide will help you understand what 5G is all about.

5G Cellular Fundamentals for Mobile Internet - Our featured guide will help you understand what 5G is all about.- Understanding Cellular Frequencies - Our guide will help you understand what different frequency bands are, and how the differences between them can be so critical.

- 5G Cellular Resources - All of our guides & articles tracking 5G.

And here is all of our recent 5G related coverage:

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of